Buying a home is one of the biggest financial decisions you’ll ever make. Before taking this significant step, it’s crucial to understand the costs and commitments involved in a mortgage. This is where mortgage calculators come into play. These tools are essential for helping you plan and make informed decisions about your purchase. In this article, we explain the importance of using a mortgage calculator and the different types you can find.

Why Use a Mortgage Calculator?

Understand Total Costs: Mortgage calculators allow you to clearly see your total monthly costs, including principal, interest, taxes, and insurance. This helps you budget appropriately and avoid financial surprises.

Financial Planning: With a calculator, you can determine how much you need to save for the down payment and closing costs. This ensures you are financially prepared to buy your home.

Compare Options: You can compare different mortgage scenarios to find the option that best fits your needs and financial situation.

Determine Affordability: Calculators like the maximum mortgage calculator help you understand how much you can afford to borrow based on your current income and debts.

Transparency: These tools provide a clear and transparent view of the costs associated with buying a home, from transfer taxes to additional expenses.

Types of Mortgage Calculators

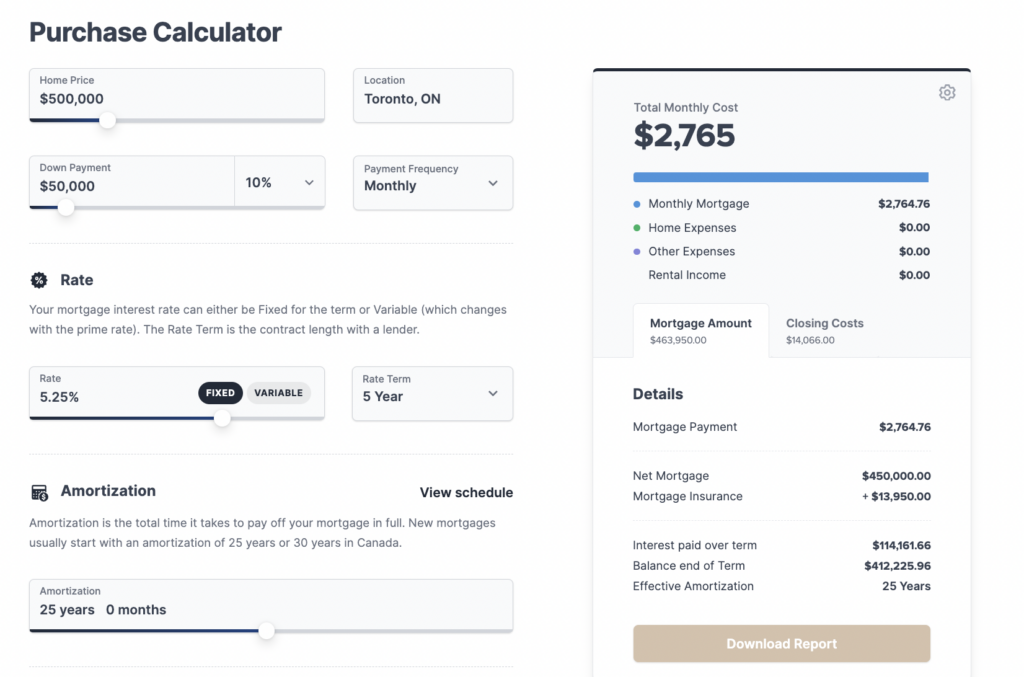

This tool allows you to calculate the total monthly cost and the minimum required down payment for buying a home. It’s ideal for those in the early stages of home-buying planning.

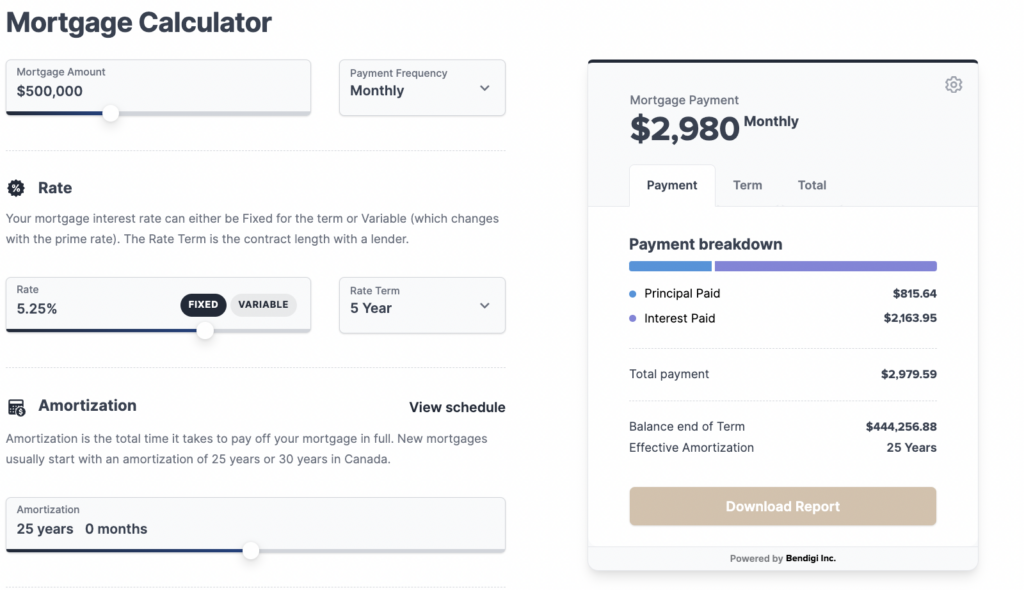

An easy-to-use Canadian mortgage calculator packed with useful features for buyers. It’s an excellent option for getting a quick and accurate estimate of your monthly payments.

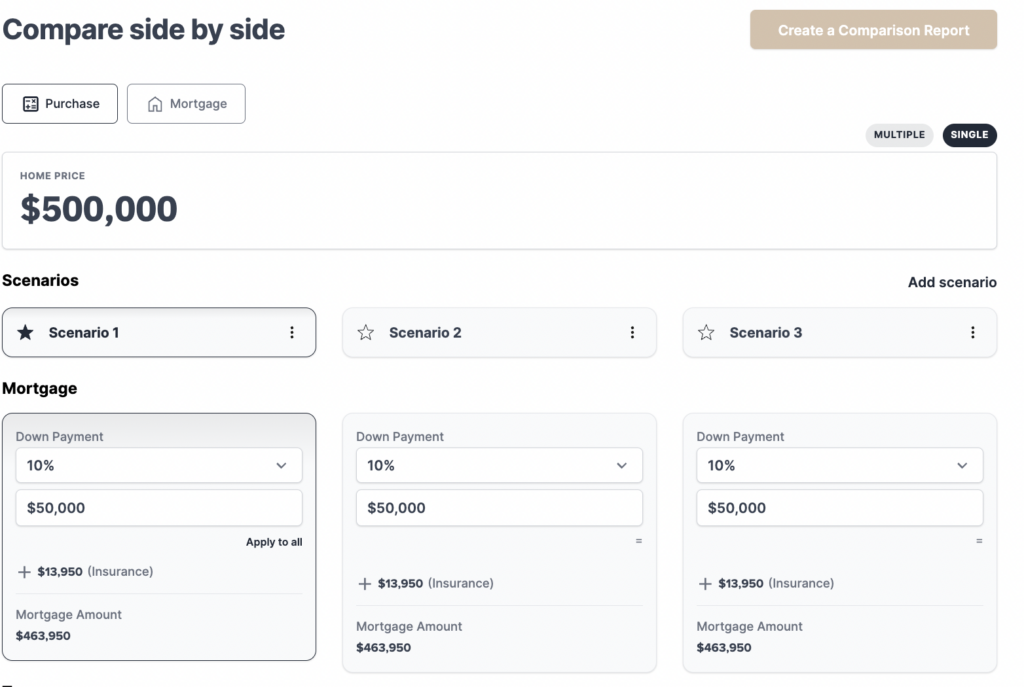

This calculator lets you compare up to four different scenarios side by side, helping you see which option is best for you. It’s useful for evaluating different mortgage terms or interest rates.

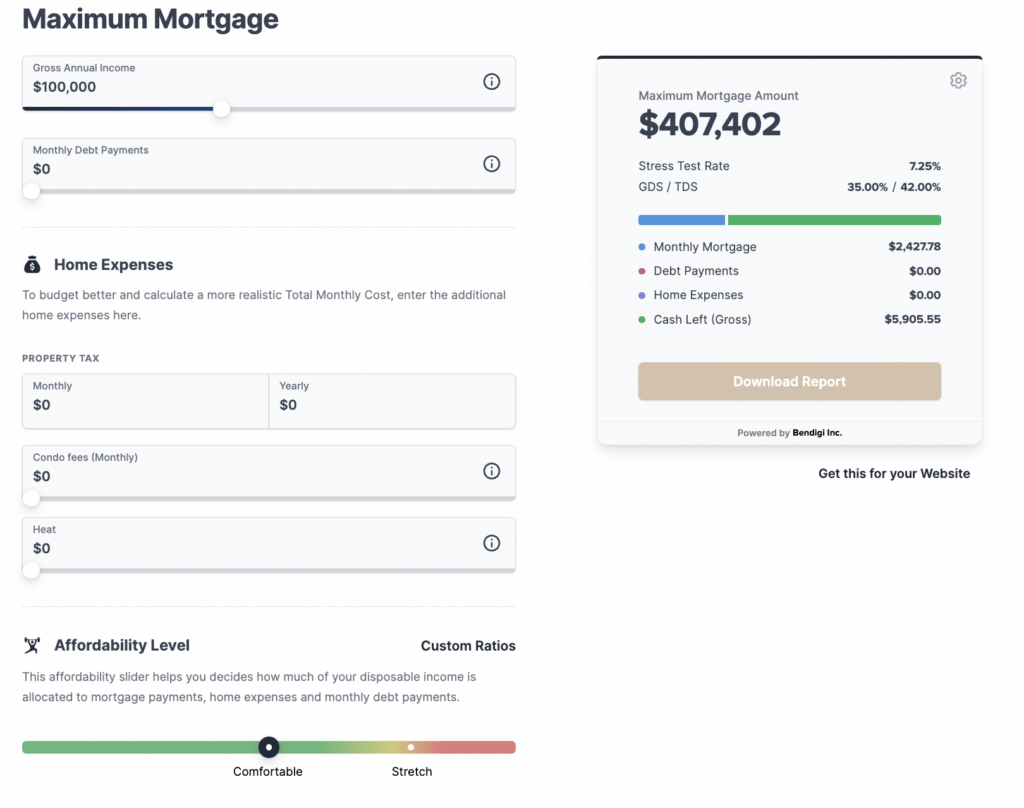

With this tool, you can calculate the maximum mortgage you can afford using an affordability slider. It’s ideal for understanding your financial limits before you start looking for properties.

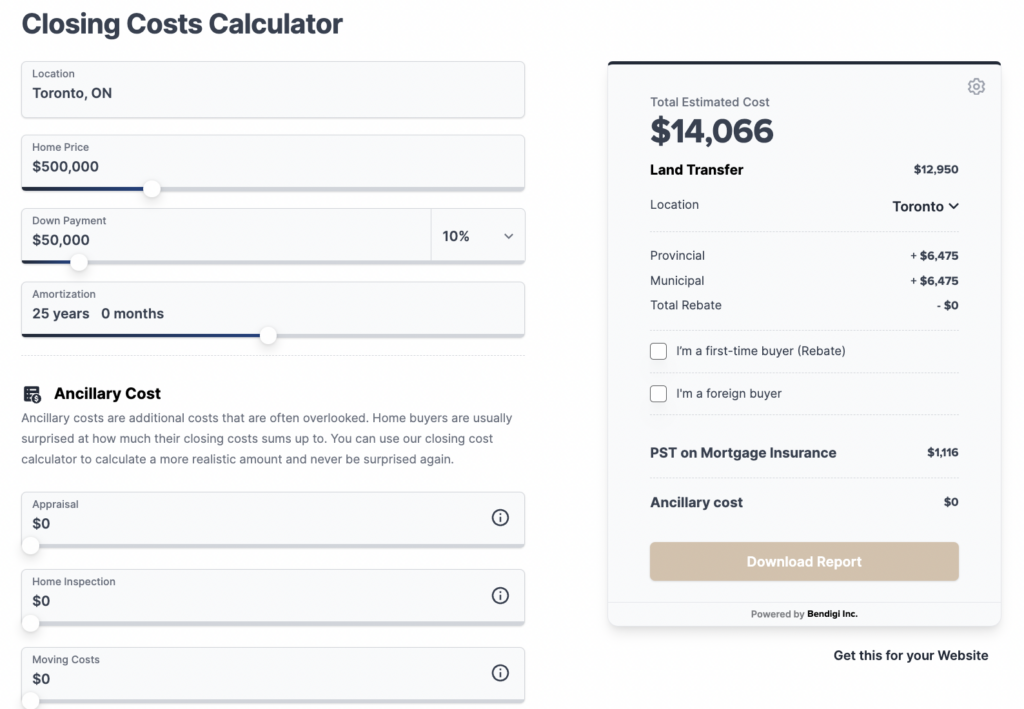

Calculate closing costs, including transfer taxes, first-time buyer rebates, new home rebates, and ancillary costs. It’s essential to get a complete picture of the additional costs you’ll face when buying a home.

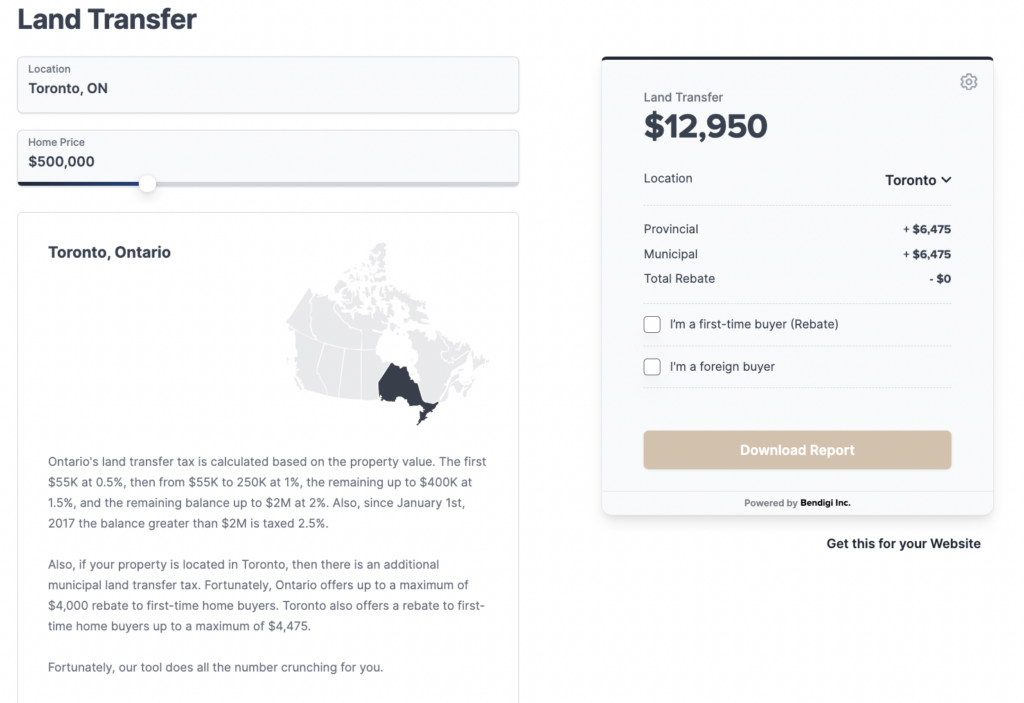

Calculate your land transfer taxes, including first-time home buyer rebates. This tool is crucial for understanding the specific costs of your location.

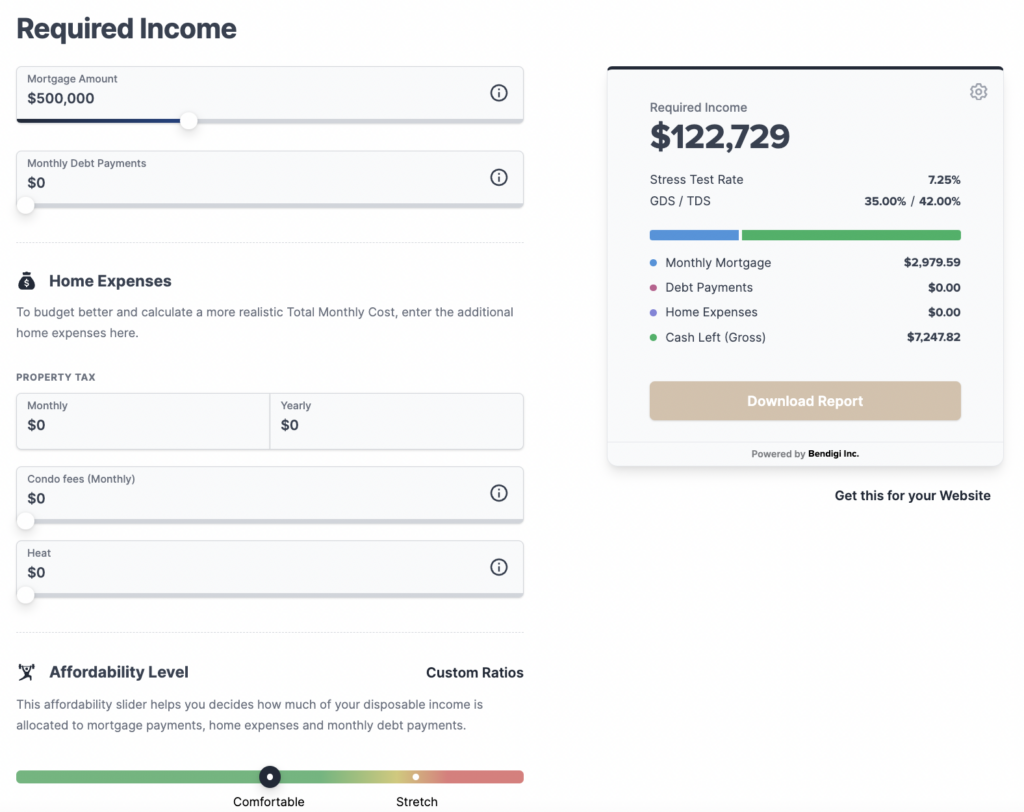

This calculator estimates how much annual income you need for any size mortgage, helping you better plan your finances and ensure you meet the lender’s income requirements.

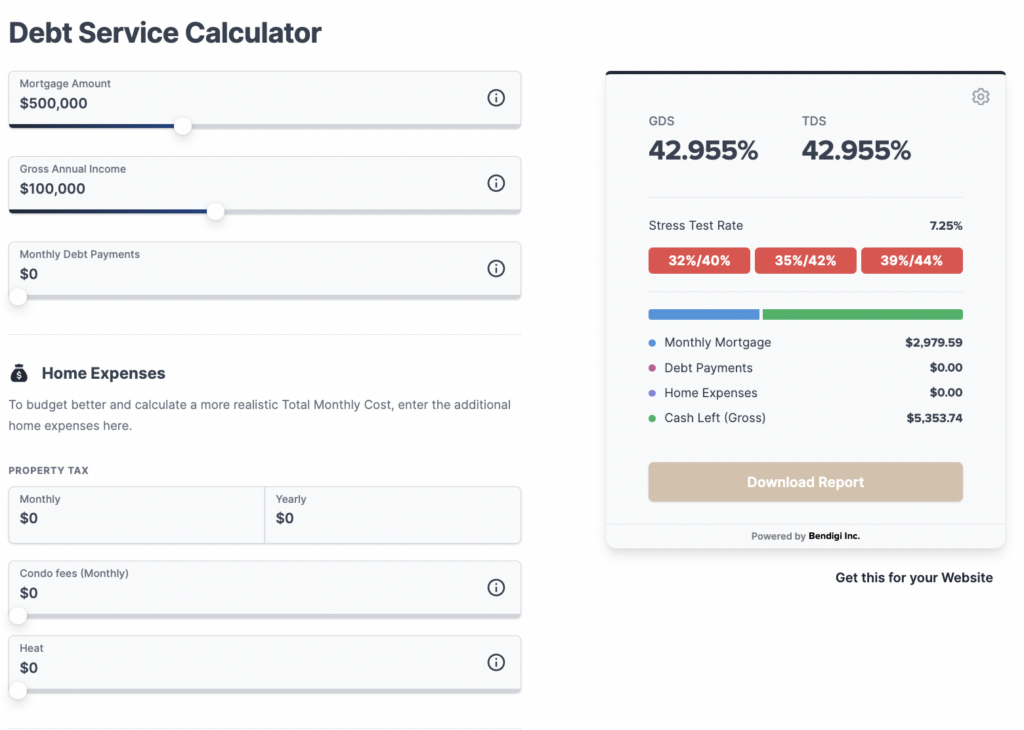

This tool allows you to assess your ability to manage your monthly debt payments in relation to your income, ensuring you don’t become financially overburdened.

Using mortgage calculators is an essential practice for any home buyer. They not only provide clarity and transparency in costs but also allow you to plan and compare different scenarios to make the best financial decision. Don’t hesitate to try these tools and take a step closer to buying your ideal home!